puerto rico tax break

Gradual adjustment tax If the individuals net taxable income exceeds USD 500000 they will have to pay an additional tax ie. A 100 tax exemption on distributions from earnings and profits a 50 tax exemption on municipal taxes and a 75-100 tax exemption on municipal and state property taxes are among the other pluses for eligible businesses.

Zero Taxes Golf And Beach Houses Create A Crypto Island Paradise Bloomberg

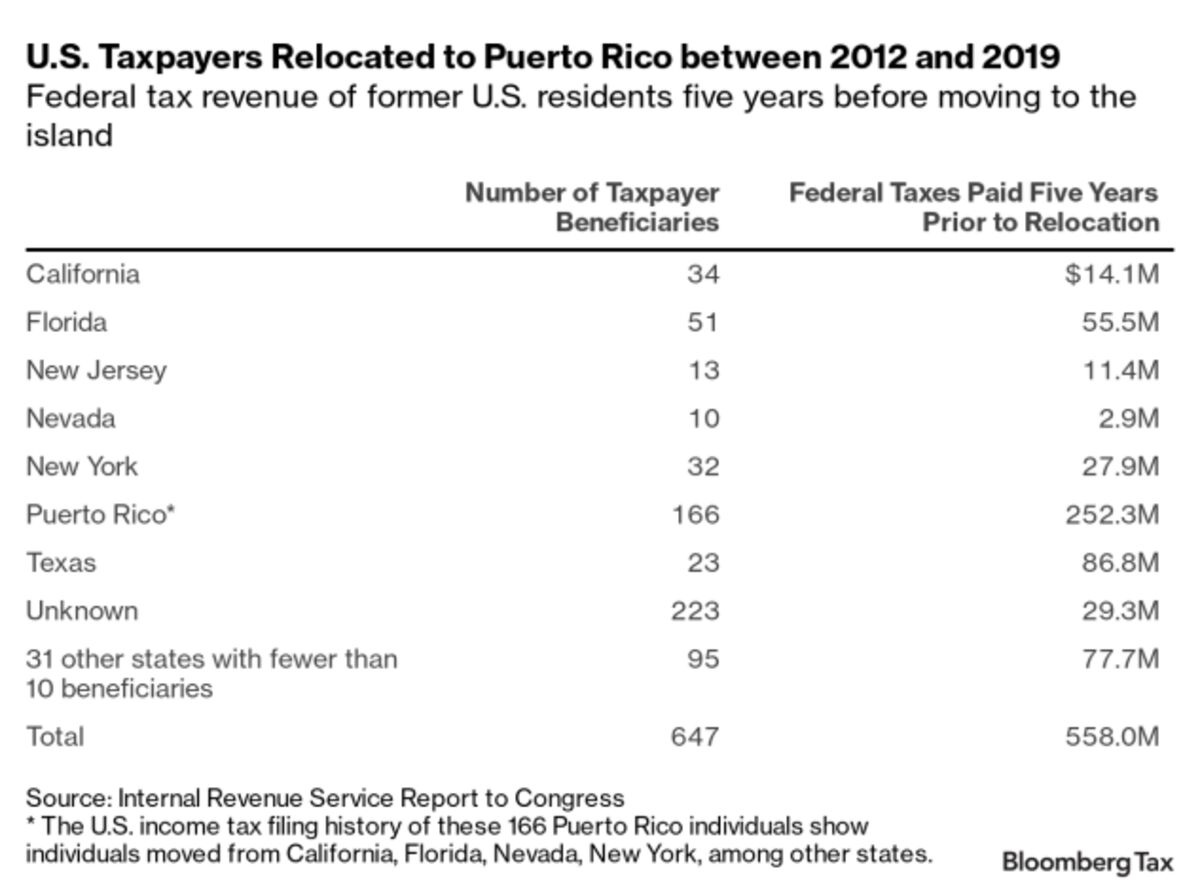

10 of the tax collected goes to the municipality where the sale was executed there are 78 municipios - municipalities and 105 of.

. Salary however is taxed at a regular rate and cannot be excluded under the FEIE. You can pay 0 tax on certain dividends and capital gains you realize while youre a bona fide resident of Puerto Rico. Puerto Rico company taxation The profit of an Act 60 company is taxed at 4 and profit taken out as a dividend is tax-free.

Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4. In 2019 the tax breaks were repackaged to attract finance tech and other investors. Impuesto a las Ventas y Uso IVU is the combined sales and use tax applied to most sales in Puerto Rico.

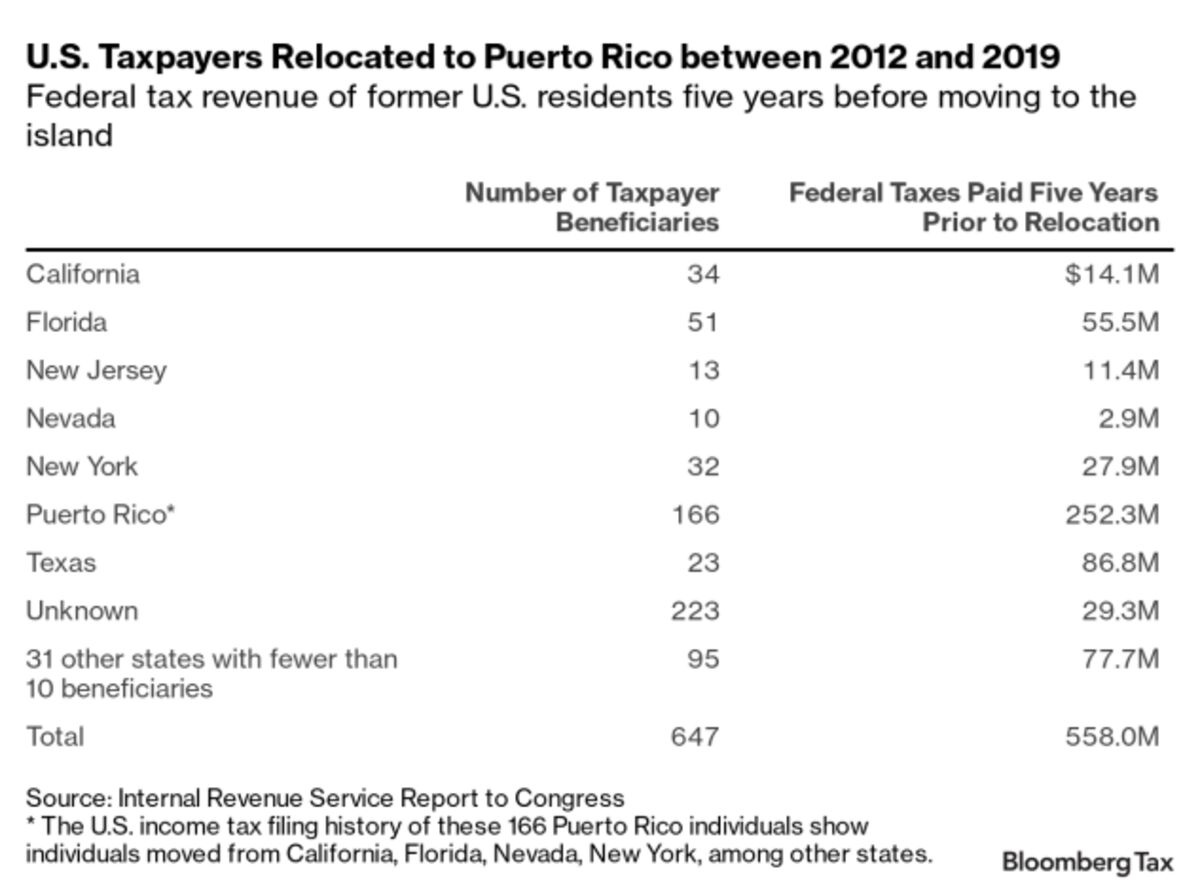

Legally avoiding the 37 federal rate and the 133 California or other state rate is a jaw-dropping benefit. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages. The investor must also buy a home to benefit from a 4 percent corporate tax rate and zero capital gains tax.

The more than three million Puerto Ricans already living on the island do not qualify for the tax breaks. Puerto Rico is becoming a crypto hub as entrepreneurs flock to the lush island. You just have to give 4 of your income to Puerto Rico.

The tax break was started by a. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will pay just 4 corporation tax and no tax. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income.

Theres also no capital gains tax. Alternate basic tax ABT. The Made-In-Puerto Rico tax break results in a total corporate tax rate of 4.

The zero tax rate covers both short-term and long-term capital gains. Take a look at all of these additional tax incentives that may apply depending on the nature of your business. Startups and bitcoin companies are finding a comfortable home there CNBC reported.

It confers a 100 tax holiday on passive income and capital gains for 20 years. You have to move to Puerto Rico to qualify. Sales and Use Tax.

In total companies are taxed 105 percent on their net income under this scheme. One of the tax breaks under Act 60 known as the Individual Investors Act drops that tax obligation down to zero if certain qualifications are met. The Puerto Rico Sales and Use Tax SUT Spanish.

The US Global Intangible Low Taxed Income GILTI mandates companies whose majority owner does not reside in Puerto Rico must pay the 4 percent corporate tax rate to Puerto Rico and an additional 65 percent rate to the federal US government. A Puerto Rican corporation thats engaged in certain types of service businesses only pays Puerto Rican tax of 4. If you move to the island you can legally pay none.

Secretary of the Treasury stated that if this issue was not dealt with it could result in the government losing as much as 7 trillion in tax revenue over the next 10 years. Under the law an investor can qualify for the tax breaks if he or she has not been a resident of Puerto Rico for at least 10 years prior. 1 the 4 corporate tax rate has existed for decades and lasts potentially decades into the future.

People who move to the island can benefit from a reduction of income taxes on. As of 2020 the tax rate is 115. This is especially huge for entrepreneurs and.

Lets get into the details and see why the deal here may not be as sweet as it looks on the surface. A report recently released by them indicated that rich taxpayers have been hiding billions of dollars in income. And 2 the tax rate is for goods and services.

You still have to take a reasonable salary and pay your employee a reasonable salary with full benefits all taxable in Puerto Rico. This tax is 5 of the excess of the total net taxable income over USD 500000 limited to 33 of their personal and dependents exemption plus USD 8895. Act 20 is for companies.

Generous tax breaks for. Act 22 is for individuals.

Puerto Rico S Taxation Of Severance Payments Ogletree Deakins

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Super Wealthy Flee Us Taxes In Puerto Rico Find Irs Auditors Already Waiting Bloomberg

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Zero Taxes Golf And Beach Houses Create A Crypto Island Paradise Bloomberg

Why I Really Moved To Puerto Rico And You Should Too Doug Casey S International Man

Puerto Rico Low Taxes Island Life Make It Hot For Bitcoin Fans

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

The Mckinsey Way To Save Puerto Rico

Puerto Rico Luring Buyers With Tax Breaks The New York Times

Guide To Income Tax In Puerto Rico

Tax Breaks For Crypto Millionaires Stir Outrage In Puerto Rico As Housing Surges Bloomberg

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc